Term life insurance is a popular way to provide financial protection for your loved ones in case of unexpected death. It offers high coverage amounts at relatively low premiums for a specific term, usually ranging from 10-30 years. However, some policyholders may face unexpected expenses or emergencies during the term that requires access to cash. In such cases, borrowing against term life insurance may seem like an attractive option.

Understanding the Basics of Borrowing Against Term Life Insurance

When you borrow against your term life insurance policy, it means taking out a loan on the value of your policy’s death benefit. The lender will use your policy as collateral for the loan and charge interest on the borrowed amount. After repaying the loan with interest, you receive what’s left of your death benefit payout.

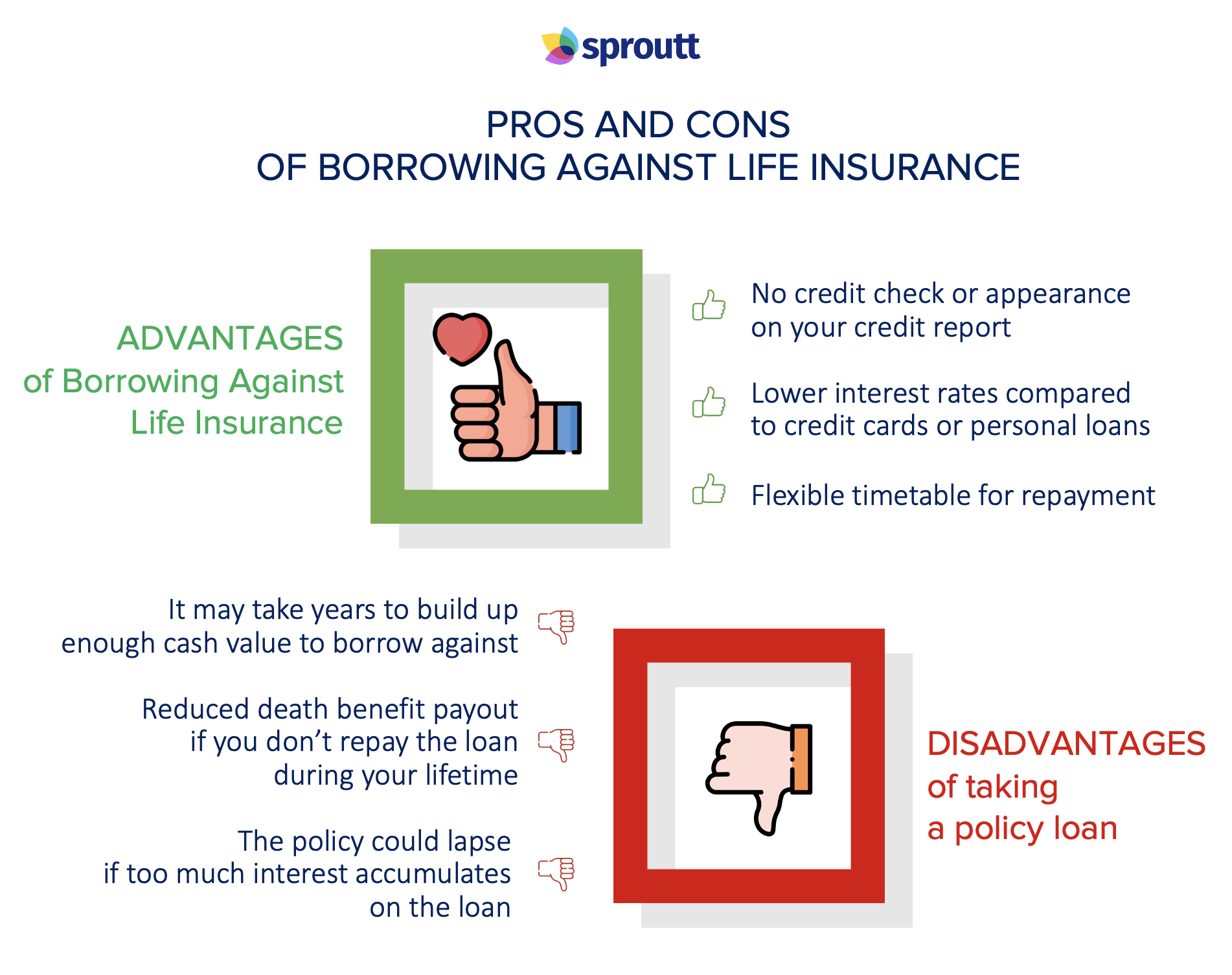

What Are the Pros?

- Quick Access to Cash – Since there are no credit checks required when borrowing against term life insurance policies, this can be an easy way for individuals with poor credit or limited income and assets to get quick cash.

- No Repayment Pressure – Unlike personal loans or lines of credit from traditional lenders where you need to adhere by strict repayment schedules, borrowing against your term life insurance comes without time constraints.

- Interest Rates – Typically lower than other types of loans because they are secured by existing assets.

What Are the Cons?

- Reducing Death Benefit Amount – If you borrow too much money from your policy’s cash value without paying back timely then it may affect entire amount which beneficiaries would otherwise receive in case Insured person dies within a Term period.

- Accrued Interest Can Be High– Although interest rates are typically lower than other types of loans because they’re secured by the policy; however if repayment delayed then accumulated interests start piling up which can substantially decrease future payouts

- Policy Termination Risk- Unpaid policies might lapse before repaying off the loan, depriving the beneficiaries of both death benefits and collateral.

Conclusion

Borrowing against term life insurance policies can have some advantages in certain situations; however, it comes with risks. The best advice is to carefully consider the pros and cons before deciding whether borrowing makes sense for your situation. As every individual has different financial goals as well as stability, so they should make up decision after consulting once with their Financial Advisor which alternative solutions may be available depending on their specific needs.

FAQs

Can I borrow against my term life insurance policy?

Yes, it is possible to borrow against a term life insurance policy that has cash value. However, not all term policies have this feature. If your policy has an accumulating cash value associated with it, you may be able to borrow against that amount while your policy remains active.

What are the pros of borrowing against a term life insurance policy?

One major advantage of borrowing against a term life insurance policy is its relatively low interest rate compared to other forms of credit such as personal loans or credit cards. Another pro is that there’s no payment deadline for loan repayment since the outstanding balance will be paid off from your death benefit if you don’t repay it before passing away.

What are the cons of borrowing against a term life insurance policy?

While there can be advantages to taking out a loan on your life insurance, there are also drawbacks to consider such as losing part or complete coverage in case you die before repaying the full debt which means reducing your beneficiary’s payout and taxes owed by them if they receive any money at all following repossession by insurer when premiums go unpaid over several years.

Additionally, taking too much out in loans could mean high lapsing cost risks – typically becoming unaffordable within 10-20 years leaving little recourse but surrender (walking away) after paying anything upfront towards settlement fees through monthly payments made towards covering debtor obligations only seeing minimal gains due excesses incurred from transaction costs during contract period.

FAQs

**H3: What is borrowing against term life insurance, and how does it work?**

Answer: Borrowing against term life insurance is a type of loan that allows policyholders to access the cash value accumulated in their policy. The policyholder borrows against the death benefit, and the loan amount is typically determined by the policy’s cash value and the insured’s life expectancy. Repayment of the loan, with interest, is required, usually through monthly premium payments.

**H3: What are the advantages of borrowing against a term life insurance policy?**

Answer: One significant advantage is that the borrowed funds are tax-free, as long as the policy remains in force. Additionally, the insured can use the borrowed funds for various purposes, such as debt consolidation, home improvements, medical expenses, or investing. Furthermore, the loan will not affect the death benefit amount, allowing the policy to continue providing financial security for beneficiaries upon the insured’s passing.

**H3: What are the potential downsides of borrowing against a term life insurance policy?**

Answer: One disadvantage is that the loan must be repaid, which means the insured may need to increase their premium payments to account for both the initial premium and the loan payments. Withdrawing funds from the policy can also reduce the death benefit amount, depending on the loan’s size. Additionally, failing to pay back the loan may result in a lapse of coverage, leaving the insured and their beneficiaries without the policy’s protection