Ever found yourself bouncing between two states and wondered, “Can I have health insurance in both places?” You’re not alone. This question often pops up among folks who split their time between two locations. Let’s unravel the mystery of dual-state health insurance.

The ABCs of Health Insurance Coverage

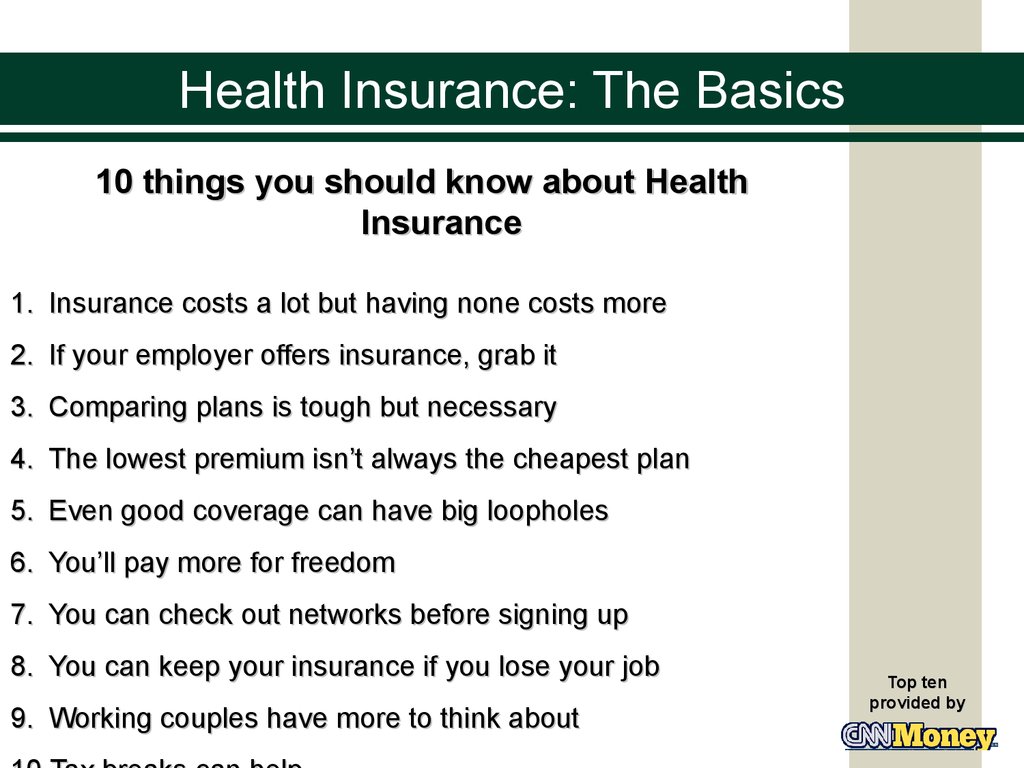

Before we dive into the nitty-gritty of dual-state coverage, let’s get a grip on how health insurance works. Typically, your health insurance policy covers medical expenses within your home state or network area. Step outside these boundaries, and your plan might give you the cold shoulder.

Moreover, each state has its own rules about the types of coverage required for its residents. So, the policies offered by providers can vary from region to region.

Can I Have Health Insurance in Two States? Absolutely!

Here’s the straight dope: you can have health insurance plans from more than one state at a time! No national law stops you from holding multiple policies across various regions.

But, like a double-edged sword, there are some things to ponder:

- Cost: Juggling multiple policies means juggling additional costs. You’ll need to weigh the benefits of paying premiums for more than one policy against the extra deductibles or out-of-pocket expenses.

- Tax implications: Depending on the state(s) where you’re buying your insurance, you might be eligible for tax credits or deductions if you purchase an individual policy through their Affordable Care Act (ACA) marketplace.

- Coverage Networks: Make sure each policy covers providers within the relevant region/network where you need treatment.

- Coordination of Benefits: With multiple policies, you’ll need to clarify which policy is the primary coverage and which one is secondary.

How to Score Coverage for Multiple States

There are two main ways to get health insurance plans across various states:

- Purchasing Private Health Insurance Plans: You can buy private health insurance plans from reputable insurers. Choose different providers from different states based on what they offer.

- COBRA Continuation Coverage: If you had group insurance and meet specific criteria, you can opt for COBRA continuation coverage.

The Bottom Line

While there are factors to consider before getting medical coverage across multiple regions, it’s doable. The key is to ensure that each policy purchased meets the required standards. Avoid overlapping areas where treatments may lead one policy to cover similar network partners twice. This could lead to issues in payment claims, affecting both policies’ standings. Do your homework and consult with experts before making any decisions.