As tax season approaches, many taxpayers are considering how to pay their taxes. One question that comes up is whether or not it’s possible to pay taxes with a credit card. In this article, we’ll explore the pros and cons of paying taxes with a credit card, as well as some tips for doing so.

The Pros of Paying Taxes with a Credit Card

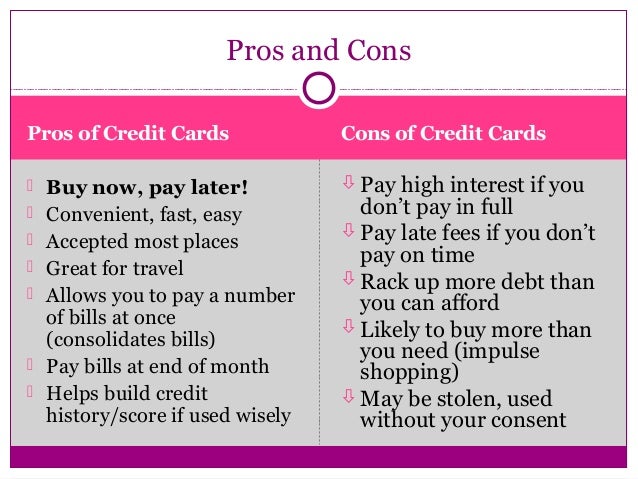

There are several advantages to using a credit card to pay your taxes:

- Convenience: Paying your taxes with a credit card can be convenient if you don’t have the funds available in your bank account.

- Rewards: Many credit cards offer rewards such as cash back or points for using them. By paying your taxes with a rewards card, you may be able to earn valuable rewards that you can use down the road.

- Ability to Spread Out Payments: If you’re unable to pay your entire tax bill at once, paying by credit card allows you to spread out payments over time while still avoiding penalties from the IRS.

The Cons of Paying Taxes with a Credit Card

Despite these benefits there are also some potential drawbacks when it comes to using plastic for Uncle Sam:

- Fees: When paying by credit card there will typically be processing fees charged which could range from 1.87% – 3.93% depending on which payment processor you choose.

- Interest Charges: If you don’t have enough funds on hand and need borrow money through carrying balance on the cc , then interest charges may apply over long terms and reduce any benefit gained through redeemable reward points or cashback

Tips for Using Your Credit Card Wisely for Tax Payments

Here are some tips if decide it’s worthy applying/taking advantage of these programs

1) Review available options – review program deals offered by government agencies alongside those offered directly via suppliers

2) Choose a rewards card with low or no fees;

3) Pay your balance on time – paying the bill off in full by regular due day to avoid any late payment penalty

4) Keep track of your credit utilization rate- Keeping balances under 30% of available credit and aim for even lower if possible.

In conclusion, whether you should pay taxes with a credit card depends on your personal financial circumstances, needs, and goals. If you have sufficient funds available or can get qualified for an installment program from IRS at a lower interest rates, it might not be worth paying processing fees charged through using cc; However, for those who have high-rewards cards but don’t enough cash flow at year end may find cnvenience and benefit from these programs especially on short term basis while maintaining good spending habits.

FAQs

Can I pay my taxes with a credit card?

Yes, you can pay your taxes with a credit card through authorized payment processors approved by the Internal Revenue Service (IRS).

What are some benefits of paying taxes with a credit card?

Using a credit card to pay your taxes can provide certain advantages, such as convenience and flexibility in payment options. Some rewards credit cards also offer points or cashback for every dollar spent on eligible purchases, including tax payments.

What are some potential drawbacks to using a credit card to pay my taxes?

One major disadvantage of paying your taxes via credit card is that it may come with additional fees charged by the authorized payment processor or merchant services provider, which could be higher than other forms of electronic payments like bank transfers or debit cards. Additionally, carrying high balances on your credit card can lead to expensive interest charges if you do not repay the balance promptly after making the tax payment.

FAQs

**H3. Can I Pay My 2024 Taxes with a Credit Card?**

Answer:Yes, many tax prep companies and governments allow you to pay taxes with a credit card for a fee.

**H3. What Are the Advantages of Paying Taxes with a Credit Card?**

Answer:Earning rewards points or cash back, spread payments over time with interest, and potentially offsetting business expenses.

**H3. What Should I Consider Before Paying My Taxes with a Credit Card?**

Answer: Consider the fees charged by the tax prep company or government, your credit card rewards, and any potential drawbacks like interest charges or impact on credit utilization