As the calendar flips to a new year and special occasions loom on the horizon, you might be thinking about showering your loved ones with gifts. But before you start handing out those checks or transferring property, let’s talk about the elephant in the room: taxes. Yes, even generosity has a tax angle. The IRS has something called a gift tax exemption, and it’s a game-changer for the generous at heart.

Unwrapping the Gift Tax Exemption

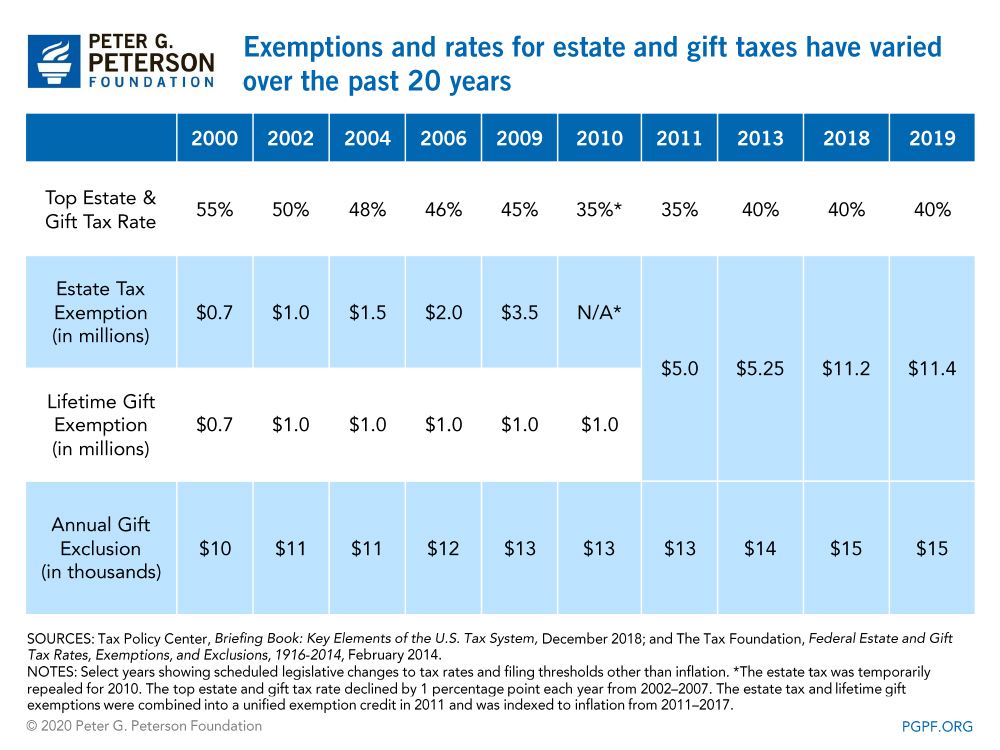

The gift tax exemption is like a golden ticket from the IRS. It allows you to give a certain amount of money each year as gifts without having to pay any federal gift taxes or file a gift tax return. For 2021, this annual exclusion was $15,000 per recipient. But hold onto your hats, because for 2024, the IRS has cranked up the generosity dial. The annual exclusion has been bumped up to a whopping $18,000 per recipient. That’s the highest it’s ever been!

Who’s on the Hook for the Gift Tax?

If you’re the one playing Santa and your gifts exceed the annual exclusion limit, you’ll be the one footing the tax bill. Any gifts that go over this limit could be taxed at rates ranging from 18% to 40%. So, it’s worth keeping an eye on those gift amounts unless you want the IRS to play the Grinch.

Strategies to Keep Your Gift Giving Tax-Efficient

Now, let’s talk strategy. There are several ways to maximize your gift-giving while keeping the tax man at bay:

- Spread Out Gifts Over Time: If you’re planning to give more than $18,000 in a year, consider spreading out your gifts over multiple years. This strategy is like a generosity marathon, not a sprint.

- Pay Medical Expenses or Tuition Directly: The IRS doesn’t put a cap on how much you can pay directly for someone else’s medical expenses or tuition fees. This is a great way to help out a loved one without triggering the gift tax.

- Use Your Lifetime Estate and Gift Tax Exclusion Limit: This provision allows individuals to give away up to $13.61 million during their lifetime. This includes both prior taxable transfers and post-death transfers.

By understanding these strategies and the IRS limits, you can keep your generosity flowing without a hefty tax bill.

Wrapping Up

When it comes to gift-giving, knowledge is power. By understanding the gift tax exemption and using creative gifting strategies, you can ensure that both you and your loved ones get the most out of each gift given. So go ahead, be generous. Just be sure to keep the IRS in mind.